“Save half.” I have heard this advice twice. The first time I heard it, I was a 21-year-old college student working part time as a customer service representative for a luxury car company. I took a call from a fatherly type. During the course of the call, he told me that he always made his children save half of whatever money they were given and then when they wanted to buy something for themselves or others, they would have the money to do so. He advised me to do the same, but as a college student, I needed every dime that I made.

The next time I heard this, it was a friend advising me what to do with my tax refund: “Save half for a rainy day.” This time, I had no reason not to. I was a college graduate and since the money was not needed for any other purpose, that is exactly what I did and have done with my tax refunds ever since.

That is not to say that emergencies have not come along to wipe those savings out because they have. And that is because for so long, that was my only savings. Not anymore. After having to start all over, I have been living far beneath my means to create a safety net for myself. Here are some tips that have helped me:

- Create multiple accounts for non-negotioble monthly expenses. In addition to a checking and a savings account, I also have an account for rent and car expenses. Every time I am paid, I immediately transfer money into those accounts, keeping my checking at bare minimum so I do not overspend.

- Take advantage of sales such as the Black Friday sales in November, the Presidents Day sales in February, the Back-to-School sales in July, etc.

- Save half of the two extra paychecks per year that I received as a teacher as well as half on any unexpected money.

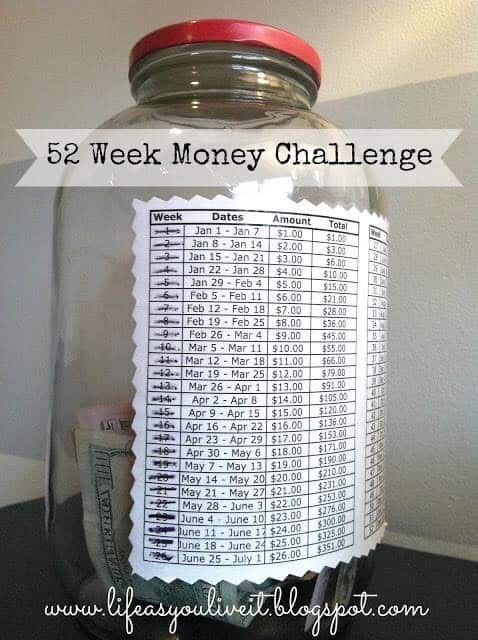

- Participate in the 52 Week Money Challenge. I do so in reverse so that as it draws near to Christmas when expenses are greater, I have less money that I need to put into savings and more to spend.

- Pay into a retirement plan.

I am definitely a work in progress in this area. What would you add to this list? Please comment below.

These are all great tips! I want to claim i’m a pro at saving but only when its convenient lol.

Thanks, Alliima, and I agree, saving is not always easy! 😄

Great advice, especially about the timing of creating an emergency fund. It’s not always the right time just because it can be too tight at times. Thanks for sharing!

Thank you. I have been without an emergency fund, and that’s never a good thing. I’m glad I figured out a strategy that works. You’re welcome. 😊

[…] See Related: How to Save […]